Representative Example: £13,000 over 66 months, 34.9% APR fixed. Monthly payment £406.79. Annual interest rate 30.31% fixed. Interest payable £13,848.14. Total repayable £26,848.14.

Minimum repayment period: 36 months. Maximum repayment period: 120 months. Maximum APR 37.9%.

Unsecured loan uses

We offer loans for various purposes including…

Unsecured loans criteria

3 steps to applying for an Unsecured loan

Complete the online application form and authorise us to review your bank account transactions via Open Banking.

One of our team will be in touch to complete an affordability assessment with you.

A few final checks and then we’ll transfer the loan funds.

Frequently asked questions about Unsecured Loans

Our loans can be used for larger expenses such as home improvements or purchasing a vehicle or for consolidating debt. We can also lend for weddings or training courses.

Yes, we’ve helped many customers looking to consolidate debts with our unsecured loans. During the application, we’ll discuss your existing debts to help understand if a debt consolidation loan would be suitable for you.

We offer loans of £3,000 up to £20,000, which can be repaid over 3 to 10 years. What’s more, our rates are fixed meaning your repayments won’t change through the term of the loan.

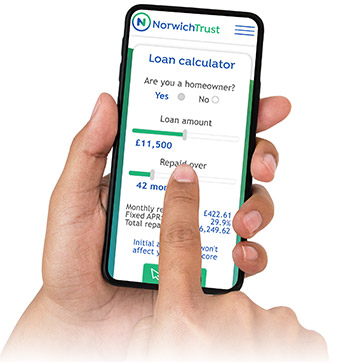

Our unsecured loan rates are based on the amount you wish to borrow. Using our unsecured loan calculator, you’ll be able to see what rate you’ll receive as well as the fixed monthly repayment.

Yes. Rather than letting a computer decide, our application process allows us to consider each case on its merits. That means that even if you’ve had credit problems in the past we could still offer you a loan.

Secured loans require collateral such as a house or car to secure the loan against. Unsecured loans don’t require any form of security.

We offer various terms depending on the amount borrowed.

- Loans under £9,000 can be repaid over 3 to 5 years

- Loans of £9,000 up to £14,999 can be repaid over 3 to 8 years

- Loans of £15,000 and over can be spread over 3 to 10 years.

- If you’re looking to borrow £20,000, the minimum loan term is 4 years.

Yes, you can settle the loan at any time but there may be early repayment charges for settling early. If you want to settle your loan in full, ask us for a settlement figure.

Please note, our loans are designed for long-term borrowing, so if you choose to settle your loan early you may find the balance has not reduced by much, if at all.

You can pay up to three times your fixed monthly payment without any added fees.

If you want to pay more than this, please contact us, and we can let you know what fees may apply.

Like most lenders, we’ll need to conduct a credit check on all applicants to help assess affordability. This is what is known as a soft credit search, which won’t affect your credit score. A hard credit search will only be made when the loan completes. This will show on your credit file and be visible to other lenders.